Published by: Anu Poudeli

Published date: 16 Jul 2023

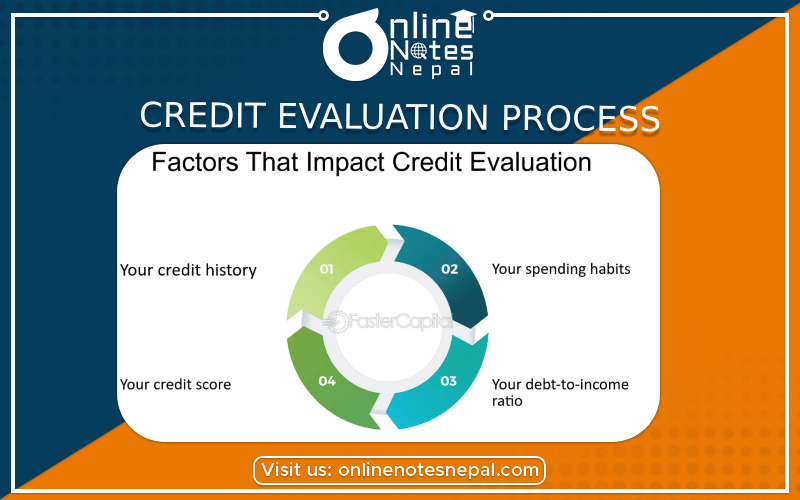

Credit evaluation is an important technique used by financial institutions such as banks and lending agencies to determine the creditworthiness of individuals or businesses wanting to borrow money. This assessment assists lenders in determining the level of risk involved in giving credit to the applicant

. Several major components of the credit evaluation process are outlined below:

1.Application and Documentation: The credit evaluation procedure begins with the borrower submitting a loan application. Personal information, financial statements, income data, employment history, and other pertinent documentation are normally required in the application.

2.Credit Report: Credit bureaus provide lenders with the applicant's credit report. The credit report summarizes a person's credit history, including credit accounts, payment history, outstanding obligations, and any late payments or defaults.

3.Credit Score: A credit score is a numerical representation of a person's creditworthiness that is based on their credit history. Lenders most commonly employ the FICO and VantageScore credit scoring algorithms.

4.Income and Debt-to-Income Ratio (DTI): Lenders evaluate an applicant's income to determine their ability to repay a loan. Divide total monthly debt payments by monthly income to get the debt-to-income ratio. A lower DTI ratio suggests a more stable financial situation.

5.Employment Stability: Lenders assess the applicant's employment stability and consistency because it represents their ability to repay.

6.Assets and Collateral: If the loan calls for collateral, such as a mortgage or auto loan, the lender assesses the value and quality of the asset supplied as security.

7.Credit Utilization Ratio: This ratio compares the applicant's credit usage to their total available credit. A high credit utilization ratio might have a negative impact on your credit score.

8.Payment History: Lenders analyze an applicant's commitment to repay bills on time by reviewing their payment history on existing loans and credit cards.

9.Credit Inquiries: The number of recent credit inquiries might have an impact on a person's credit score because a high number of queries may suggest a higher degree of risk.

10. Credit policy and Risk Tolerance : Credit rules and risk tolerance vary per lender. Some lenders may be more flexible.

11.Loan Purpose: The loan's purpose can have an impact on the appraisal process. A loan for a business initiative, for example, may be judged differently from a personal loan for a trip.

The lender will either approve or deny the credit application based on the evaluation, and if authorized, they will decide the loan terms, including the interest rate, payback duration, and any other applicable restrictions.

To boost their chances of acceptance and acquire more favorable loan terms, applicants must maintain a solid credit history and financial status. Some techniques to enhance creditworthiness include monitoring one's credit report on a regular basis, paying bills on time, and managing debts responsibly.